Home>Sports>Reasons Why 60 Percent Of Ex NBA Players Go Bankrupt Few Years After Retirement

Sports

Reasons Why 60 Percent Of Ex NBA Players Go Bankrupt Few Years After Retirement

Published: January 25, 2024

Discover the financial challenges faced by ex-NBA players post-retirement and the reasons behind their high bankruptcy rate. Explore the impact of sports careers on personal finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Noodls.com, at no extra cost. Learn more)

Table of Contents

Introduction

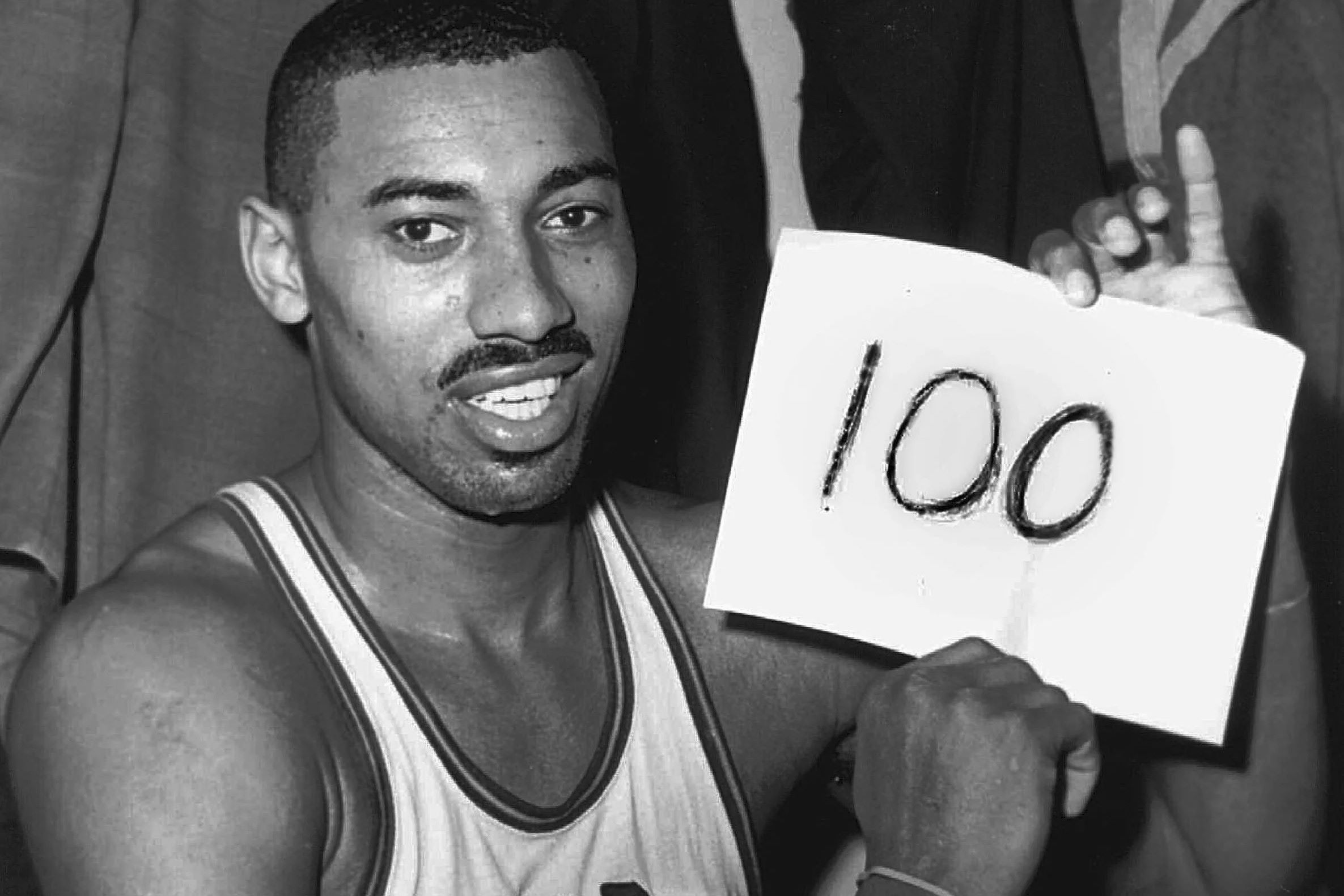

Retiring from a successful career in the NBA should be a time of celebration and financial security. However, the reality is often starkly different. Shockingly, statistics reveal that approximately 60 percent of ex-NBA players face financial turmoil within just a few years of retirement. This alarming trend raises significant concerns and prompts a closer examination of the underlying factors contributing to this widespread issue.

The transition from a lucrative professional basketball career to post-retirement life can be tumultuous for many athletes. While the reasons behind this financial downfall are multifaceted, they often stem from a combination of factors, including a lack of financial education, extravagant spending habits, ill-advised investment decisions, unforeseen legal troubles, and the burden of family support. These challenges, when compounded, can lead to a rapid depletion of wealth and financial stability.

The plight of ex-NBA players serves as a cautionary tale, shedding light on the importance of financial literacy, prudent decision-making, and long-term planning. By delving into the specific reasons behind the high rate of bankruptcy among former NBA stars, we can gain valuable insights into the financial pitfalls that athletes often encounter post-retirement. This exploration is crucial not only for athletes but also for individuals from all walks of life, as it underscores the significance of sound financial management and the potential consequences of unchecked spending and financial mismanagement.

In the subsequent sections, we will delve into the intricate web of factors contributing to the financial challenges faced by ex-NBA players, shedding light on the lack of financial education, overspending and lifestyle inflation, poor investment decisions, health expenses and insurance, divorce and family support, entourage and hangers-on, and unforeseen legal troubles. By examining each of these factors, we aim to provide a comprehensive understanding of the complex dynamics that can lead to financial instability post-retirement.

The following exploration will not only offer valuable insights into the financial struggles of ex-NBA players but also serve as a pertinent reminder of the importance of financial prudence and long-term planning for individuals across all professions. Through this examination, we can glean essential lessons that transcend the realm of professional sports, resonating with anyone seeking to secure their financial future and avoid the pitfalls that have befallen many former NBA stars.

Lack of Financial Education

The lack of financial education stands as a formidable barrier to the long-term financial well-being of many ex-NBA players. Despite their immense success on the court, the majority of athletes are not equipped with the necessary knowledge and skills to effectively manage their substantial earnings. This deficiency in financial literacy often manifests in a myriad of detrimental financial decisions, ultimately leading to dire consequences post-retirement.

One of the primary manifestations of this lack of financial education is the inability to discern between good and bad investment opportunities. Without a solid understanding of financial principles, many athletes fall prey to unscrupulous financial advisors or make ill-informed investment choices, resulting in significant financial losses. Moreover, the absence of financial acumen leaves them vulnerable to fraudulent schemes and high-risk investments, further exacerbating their financial instability.

Additionally, the dearth of financial education contributes to a lack of prudent budgeting and financial planning. Many ex-NBA players, accustomed to substantial incomes during their playing careers, struggle to adjust to a more modest lifestyle post-retirement. Without the foundational knowledge to manage their finances effectively, they often succumb to extravagant spending habits and fail to establish a sustainable financial plan for the future.

Furthermore, the absence of financial education leaves ex-NBA players susceptible to financial exploitation and mismanagement. Without the ability to discern the intricacies of complex financial instruments and contracts, they may fall victim to predatory financial practices, leading to substantial financial losses and instability.

In essence, the lack of financial education among ex-NBA players underscores the critical need for comprehensive financial literacy programs and resources tailored to the unique financial challenges faced by professional athletes. By equipping athletes with the knowledge and skills necessary to navigate the complexities of personal finance, they can make informed decisions, mitigate financial risks, and secure their long-term financial well-being.

The ramifications of this lack of financial education extend far beyond the realm of professional sports, serving as a poignant reminder of the pervasive impact of financial illiteracy. It underscores the imperative for individuals from all walks of life to prioritize financial education, empowering them to make sound financial decisions and safeguard their financial futures.

Overspending and Lifestyle Inflation

Overspending and lifestyle inflation represent significant contributors to the financial challenges faced by ex-NBA players post-retirement. During their illustrious careers, these athletes often enjoy substantial incomes, enabling them to indulge in a lavish lifestyle characterized by extravagant purchases, high-end properties, luxury vehicles, and opulent vacations. However, this elevated standard of living becomes ingrained, leading to lifestyle inflation that can have detrimental long-term consequences.

The transition from a high-flying career in professional basketball to post-retirement life necessitates a fundamental shift in financial mindset. Unfortunately, many ex-NBA players struggle to reconcile their previous extravagant spending habits with the financial realities of retirement. As a result, they continue to maintain exorbitant lifestyles, often exceeding their post-retirement income and depleting their savings at an alarming rate.

Moreover, the allure of luxury and opulence, which was once easily attainable during their playing careers, becomes increasingly unsustainable post-retirement. This mismatch between their accustomed lifestyle and their post-career financial resources creates a precarious financial imbalance, leading to dire consequences.

Furthermore, the pressures of societal expectations and the desire to uphold a certain image contribute to the perpetuation of extravagant spending habits. Ex-NBA players, accustomed to adulation and admiration during their playing days, often feel compelled to sustain an extravagant lifestyle to maintain their public persona. This external pressure, coupled with internalized expectations, fuels a cycle of excessive spending that undermines their financial stability.

The phenomenon of lifestyle inflation, characterized by an upward spiral of spending to maintain a certain standard of living, poses a formidable challenge for ex-NBA players. The inability to adjust to a more modest lifestyle post-retirement, coupled with the allure of opulence and societal pressures, perpetuates a cycle of overspending that can lead to financial ruin.

In essence, the pervasive issue of overspending and lifestyle inflation underscores the critical need for financial prudence and a realistic assessment of post-retirement financial capabilities. By addressing these challenges and embracing a more modest lifestyle, ex-NBA players can mitigate the risks of financial instability and secure their long-term financial well-being. This imperative extends beyond the realm of professional sports, serving as a poignant reminder of the importance of prudent financial management and the potential consequences of unchecked spending habits.

Poor Investment Decisions

Poor investment decisions represent a pervasive challenge that significantly contributes to the financial turmoil experienced by ex-NBA players post-retirement. Despite their substantial earnings during their playing careers, many athletes encounter substantial financial losses due to ill-advised investment choices, speculative ventures, and a lack of diversified investment portfolios.

One of the primary factors contributing to poor investment decisions is the influence of unscrupulous financial advisors and opportunistic individuals seeking to capitalize on the athletes' wealth. Ex-NBA players, often lacking the necessary financial acumen, may fall victim to misleading investment schemes and fraudulent opportunities, leading to substantial financial losses. The allure of high returns and promises of lucrative ventures can cloud their judgment, resulting in investments that fail to yield the anticipated profits and, in some cases, lead to financial ruin.

Moreover, the absence of a well-defined investment strategy and long-term financial planning exacerbates the susceptibility of ex-NBA players to poor investment decisions. Without a comprehensive understanding of diversified investment vehicles, risk management, and the implications of speculative ventures, athletes may allocate their wealth into high-risk, illiquid assets that lack the stability and growth potential necessary to secure their financial future.

Additionally, the lack of prudent due diligence and financial oversight further compounds the challenges associated with poor investment decisions. Ex-NBA players, often preoccupied with the demands of their playing careers, may entrust their financial affairs to individuals who do not have their best interests at heart. This misplaced trust can result in investments that do not align with their long-term financial objectives, leading to substantial financial setbacks and instability.

The repercussions of poor investment decisions extend far beyond the realm of professional sports, underscoring the critical importance of sound financial management and informed investment strategies. By addressing the underlying factors contributing to poor investment decisions and empowering athletes with the necessary financial knowledge and resources, ex-NBA players can mitigate the risks of financial instability and safeguard their wealth post-retirement.

In essence, the prevalence of poor investment decisions among ex-NBA players serves as a poignant reminder of the imperative for comprehensive financial education, prudent investment strategies, and diligent financial oversight. By equipping athletes with the tools to make informed investment decisions and navigate the complexities of the financial landscape, they can mitigate the risks of financial turmoil and secure their long-term financial well-being.

Health Expenses and Insurance

The burden of health expenses and insurance presents a formidable challenge for many ex-NBA players post-retirement. Throughout their illustrious careers, these athletes often endure rigorous physical demands, facing a myriad of injuries and health-related issues resulting from the intense nature of professional basketball. As they transition into retirement, the cumulative toll of these physical challenges becomes increasingly pronounced, necessitating comprehensive healthcare and insurance coverage to address their evolving medical needs.

The exorbitant costs associated with healthcare, including specialized medical treatments, rehabilitation services, and ongoing therapeutic interventions, place a significant strain on the financial resources of ex-NBA players. Moreover, the prevalence of chronic injuries sustained during their playing careers often necessitates long-term medical care and support, further exacerbating the financial burden. The absence of employer-sponsored healthcare coverage post-retirement compounds these challenges, leaving many athletes to navigate the complexities of the healthcare system independently.

Furthermore, the need for comprehensive insurance coverage to mitigate the financial impact of unforeseen health crises is paramount. Ex-NBA players, accustomed to the robust healthcare benefits provided during their playing careers, may encounter substantial challenges in securing affordable and comprehensive insurance post-retirement. The absence of employer-sponsored insurance plans and the need for specialized coverage tailored to their unique medical needs further complicates the process of obtaining adequate insurance protection.

The financial implications of health expenses and insurance extend beyond the realm of medical treatments, encompassing the broader spectrum of healthcare-related costs. From prescription medications and therapeutic interventions to specialized consultations and ongoing medical monitoring, the cumulative expenses associated with healthcare can rapidly deplete the financial resources of ex-NBA players, leading to financial instability and uncertainty.

In essence, the burden of health expenses and insurance underscores the critical need for comprehensive healthcare planning and insurance coverage tailored to the evolving medical needs of ex-NBA players post-retirement. By addressing these challenges and advocating for accessible healthcare resources and affordable insurance options, athletes can mitigate the financial strain associated with healthcare and safeguard their long-term financial well-being.

The ramifications of health expenses and insurance extend far beyond the realm of professional sports, resonating with individuals from all walks of life who face similar challenges in navigating the complexities of healthcare and insurance. By shedding light on these pervasive issues, we underscore the imperative for accessible healthcare resources, affordable insurance options, and comprehensive healthcare planning to ensure the financial stability and well-being of individuals post-retirement.

Divorce and Family Support

The complexities of divorce and family support present significant challenges for many ex-NBA players post-retirement. The transition from a high-profile career in professional basketball to post-retirement life often entails a reevaluation of familial relationships, financial obligations, and the intricacies of divorce settlements. The unique financial dynamics and public visibility associated with professional sports careers can amplify the complexities of divorce proceedings and family support arrangements, leading to substantial financial implications and emotional strain.

In the aftermath of divorce, ex-NBA players may encounter formidable financial obligations, including alimony, child support, and equitable distribution of assets. The substantial wealth accumulated during their playing careers can become subject to intricate legal proceedings, often resulting in significant financial settlements and ongoing support obligations. The intricacies of divorce settlements, coupled with the emotional toll of familial discord, can lead to protracted legal battles and substantial financial outlays, further exacerbating the challenges faced by ex-NBA players post-retirement.

Moreover, the public scrutiny and heightened visibility of high-profile athletes can magnify the complexities of divorce and family support, placing ex-NBA players under intense public scrutiny and emotional distress. The intricacies of navigating familial relationships in the public eye, coupled with the financial ramifications of divorce settlements, can have profound implications for the long-term financial well-being and emotional stability of these athletes.

Furthermore, the need to provide ongoing financial support for children and former spouses can place a substantial strain on the financial resources of ex-NBA players, potentially leading to financial instability and uncertainty. The intersection of familial obligations, legal proceedings, and financial implications underscores the critical need for comprehensive legal counsel, emotional support, and financial planning to navigate the complexities of divorce and family support post-retirement.

In essence, the complexities of divorce and family support serve as a poignant reminder of the multifaceted challenges faced by ex-NBA players post-retirement. By addressing these challenges and advocating for comprehensive legal and financial resources tailored to the unique circumstances of professional athletes, we can mitigate the financial strain and emotional distress associated with divorce and family support, safeguarding the long-term well-being of these athletes.

Entourage and Hangers-On

The phenomenon of entourage and hangers-on represents a pervasive challenge that significantly contributes to the financial turmoil experienced by ex-NBA players post-retirement. Throughout their illustrious careers, these athletes often accrue a circle of individuals, including friends, family members, acquaintances, and opportunistic individuals, collectively known as the entourage. While the intentions of these individuals may initially appear benign, the presence of an entourage can have profound financial implications, leading to excessive financial burdens and a depletion of wealth post-retirement.

The allure of fame, success, and substantial wealth often attracts a multitude of individuals seeking to capitalize on the financial resources of ex-NBA players. The entourage, comprising individuals from diverse backgrounds, may exert undue influence on the financial decisions of the athletes, leading to extravagant spending, ill-advised investments, and financial mismanagement. The pervasive presence of the entourage can create a culture of excessive spending, unchecked financial obligations, and a lack of prudent financial oversight, ultimately undermining the long-term financial stability of the athletes.

Moreover, the entourage often perpetuates a cycle of financial dependency, wherein ex-NBA players feel compelled to provide financial support to numerous individuals within their circle. This financial burden, compounded by the pressures of maintaining an extravagant lifestyle and meeting the expectations of the entourage, can lead to substantial financial strain and instability. The absence of clear boundaries and financial accountability within the entourage further exacerbates these challenges, leading to a rapid depletion of wealth and financial resources.

Furthermore, the entourage can engender an environment of financial exploitation and opportunism, wherein individuals within the circle seek to benefit from the wealth of the athletes without contributing to their long-term financial well-being. The absence of genuine financial guidance and support within the entourage can lead to ill-advised financial decisions, speculative ventures, and a lack of prudent financial planning, ultimately jeopardizing the financial future of the ex-NBA players.

In essence, the pervasive influence of the entourage and hangers-on underscores the critical need for comprehensive financial education, prudent financial decision-making, and the establishment of clear boundaries within the social circles of ex-NBA players. By addressing the challenges associated with the entourage and advocating for financial accountability and prudent financial management, athletes can mitigate the risks of financial instability and safeguard their long-term financial well-being.

The ramifications of the entourage and hangers-on extend far beyond the realm of professional sports, resonating with individuals from all walks of life who may encounter similar challenges in managing their social circles and financial resources. By shedding light on the pervasive impact of the entourage, we underscore the imperative for financial autonomy, prudent decision-making, and the cultivation of a supportive social environment conducive to long-term financial stability.

Unforeseen Legal Troubles

The specter of unforeseen legal troubles looms ominously over the post-retirement lives of many ex-NBA players, posing a significant threat to their financial stability and overall well-being. Despite their celebrated careers on the basketball court, these athletes often find themselves entangled in complex legal disputes, ranging from contractual disagreements and financial litigation to personal legal entanglements, leading to substantial legal expenses, emotional distress, and reputational challenges.

One of the primary factors contributing to unforeseen legal troubles is the intricate web of contractual obligations and financial arrangements that characterize the professional sports industry. Ex-NBA players, accustomed to navigating the complexities of player contracts, endorsement deals, and financial agreements during their playing careers, may encounter legal disputes and contractual disagreements post-retirement. The intricacies of contractual interpretation, financial obligations, and endorsement disputes can lead to protracted legal battles, substantial legal fees, and emotional strain, further exacerbating the challenges faced by these athletes.

Moreover, the heightened public visibility and scrutiny associated with professional sports careers can magnify the impact of unforeseen legal troubles, placing ex-NBA players under intense public scrutiny and reputational challenges. Legal disputes, whether stemming from financial disagreements, personal matters, or contractual disputes, can have profound implications for the public image and personal well-being of these athletes, leading to emotional distress and reputational damage.

Furthermore, the absence of comprehensive legal counsel and financial oversight post-retirement can leave ex-NBA players vulnerable to unforeseen legal troubles, exacerbating the financial strain and emotional toll associated with legal disputes. The need for accessible legal resources, comprehensive legal counsel, and proactive legal planning becomes increasingly pronounced as these athletes navigate the complexities of post-retirement life, safeguarding their financial stability and emotional well-being.

In essence, the prevalence of unforeseen legal troubles among ex-NBA players underscores the critical need for comprehensive legal counsel, proactive legal planning, and the cultivation of a supportive legal framework to mitigate the risks of legal disputes and safeguard the long-term well-being of these athletes. By addressing the challenges associated with unforeseen legal troubles and advocating for accessible legal resources, ex-NBA players can navigate the complexities of post-retirement life with resilience and financial stability, ensuring their long-term well-being and peace of mind.

Conclusion

The financial challenges faced by ex-NBA players post-retirement are multifaceted and underscore the imperative for comprehensive financial education, prudent decision-making, and long-term planning. The alarming statistic that approximately 60 percent of former NBA stars encounter financial turmoil within a few years of retirement serves as a poignant reminder of the pervasive impact of financial mismanagement and the complexities of post-career financial transitions.

The lack of financial education, characterized by a deficiency in financial literacy and the inability to make informed financial decisions, stands as a formidable barrier to the long-term financial well-being of ex-NBA players. This underscores the critical need for tailored financial literacy programs and resources to equip athletes with the knowledge and skills necessary to navigate the complexities of personal finance.

Moreover, the prevalence of overspending, lifestyle inflation, poor investment decisions, health expenses, divorce and family support, entourage influence, and unforeseen legal troubles collectively contribute to the financial challenges faced by ex-NBA players. These factors highlight the need for comprehensive financial planning, prudent decision-making, and the cultivation of a supportive financial and social environment conducive to long-term financial stability.

In addressing these challenges, ex-NBA players can benefit from proactive financial education, prudent financial management, and the establishment of clear boundaries within their social circles. By advocating for accessible healthcare resources, affordable insurance options, and comprehensive legal counsel, these athletes can navigate the complexities of post-retirement life with resilience and financial stability.

The lessons gleaned from the financial struggles of ex-NBA players resonate beyond the realm of professional sports, serving as a pertinent reminder of the importance of sound financial management and the potential consequences of unchecked spending and financial mismanagement. By embracing a holistic approach to financial well-being and prioritizing long-term financial planning, individuals from all walks of life can secure their financial futures and avoid the pitfalls that have befallen many former NBA stars.